QUICK STATS

3 years & up

30 minutes/chapter

Books, Textbooks

272 pages

Money Management

Personal Finance

Investing

Which is easier, talking to your kids about the birds and the bees or about banks and borrowing? If you’re squeamish about money topics, or love talking about money but want a comprehensive guide to make sure you’re being thorough, then the book in this review might be just what you need. Make Your Kids a Money Genius (even if you’re not) outlines 10 crucial money topics you need to cover with your kids “from 3 to 23 years old.” Want to see numerical summary ratings? Skip to the conclusion for our detailed criteria breakdown and final review score.

Is “Make Your Kid a Money Genius” fun and educational?

Reviewing this book is a departure from our normal learning games. However, it does fit well with our goal of making difficult topics fun. Here’s why: the author, Beth Kobliner, shows you how to integrate financial literacy into everyday life. She takes a wide array of financial topics, from debt to budgeting to insurance and investing, and examines each one through the lens of six different age groups: preschool, elementary, middle school, high school, college, and “young adulthood” (which seems to be getting later and later with each successive generation). By involving your kids in the process of financial decision-making, you’ll make them full participants in their education about money.

Without going into a complete rundown of the book’s content, I’ll pull out some favorite passages that I highlighted as being particularly fun ways to teach financial concepts to kids.

Tradeoffs

The book covers budgeting in depth, but for kids who are old enough, Mr. Kobliner advocates strong lessons in trade-offs that reinforce the concepts of delayed gratification and saving. Assuming you have a monthly budget set up already, the book outlines discussion topics that allow you to include your whole family, adjusting your messaging to each age level. An example you might find in our family would be: “If we budget $100 in to Dining Out this month, that only leaves $25 for Vacation Savings, which gives us one trip every four years. Is this acceptable, or do we need to cut something else to allocate more to vacation savings?” When kids see the fixed pie of monthly spending, they’ll be more motivated to help cut expenses, prioritize favorites, and–for entrepreneurial families–help increase the total pie by working on a family business.

A specific trade-offs anecdote that the book highlights involves a son asking his dad for a fancy pair of sneakers. Remembering the angst of his own teenage shoe status woes, the dad decided to parcel out a large sum of money for a good pair. But he did it in a sneaky way (see what I did there?): he gave his son a gift card to a sporting goods store and decided to let the young man divide the amount between shoes and other sporting equipment, as he saw fit. The son ultimately chose a cheaper pair of shoes and a new leather basketball. This type of involvement gives kids the practical experience needed to develop their financial “muscles.” Guided experience with real money trade-off decisions helps kids of all ages avoid bad decisions later in life.

Let. Them. Fail!

Have you ever taken charge of a kid’s science fair project? What about a history report or art lesson? The temptation to intervene is great when you think academic peril is at risk. You might not even realize you’re doing it when it comes to financial matters, especially business ventures. Make Your Kid a Money Genius discusses this tendency by showcasing a lemonade stand the author visited. Every square inch of the “kid’s” stand had been ripped from a Pottery Barn catalog. The graphics professionally calligraphed. The lemonade herbally infused. If you, as a parent, are “taking over” a venture because you think you’re insulating your kids from the harsh realities of the cutthroat business world, this kind of protection will backfire, asserts Ms. Kobliner. You need to give kids room to make their own mistakes, deep dive into understanding opportunities for improvement, and learn the valuable lessons that failures provide.

Have you ever taken charge of a kid’s science fair project? What about a history report or art lesson? The temptation to intervene is great when you think academic peril is at risk. You might not even realize you’re doing it when it comes to financial matters, especially business ventures. Make Your Kid a Money Genius discusses this tendency by showcasing a lemonade stand the author visited. Every square inch of the “kid’s” stand had been ripped from a Pottery Barn catalog. The graphics professionally calligraphed. The lemonade herbally infused. If you, as a parent, are “taking over” a venture because you think you’re insulating your kids from the harsh realities of the cutthroat business world, this kind of protection will backfire, asserts Ms. Kobliner. You need to give kids room to make their own mistakes, deep dive into understanding opportunities for improvement, and learn the valuable lessons that failures provide.

Understanding Risk and Reward: Why Certain Schemes Are Dumb

This last topic is a tough one for me. The author advocates letting kids try certain things, in a controlled way, to experience the disappointment for themselves. Instead of telling kids that gambling is a bad idea, let them play the lottery, she says. But only three times. If the kid uses his or her own money, plunking down $10 bucks for a losing PowerBall ticket three weeks in a row, they’ll be much more receptive to a discussion of probability, odds, and your lecture about “the house always wins.” I would struggle with taking this advice because I find gambling revolting in any form. I take plenty of measured risk in my business life (working on this blog full-time without a salary, for example), but the inherent lack of skill and insidious greed associated with gambling has always turned me off.

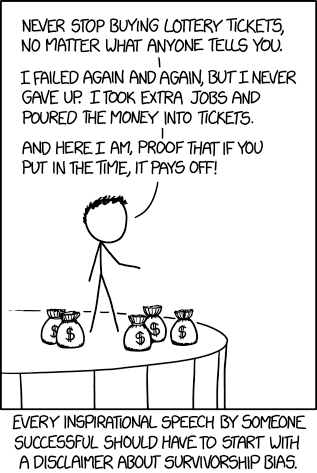

If you do discuss lotteries and other get-rich-quick schemes with your youngster, be sure to discuss the power that our news media, especially celebrities, have on your pysche. For every Jeff Bezos, there are 1,000 e-commerce failures. Even Jeff Bezos will be the first to point out how many times he’s failed: the recent announcement of Quidsi’s imminent demise is a good example. Since Amazon purchased Quidsi in 2010 for over half a billion dollars and then lost money on that business unit for seven straight years, this must have been a difficult lesson indeed.

We only listen to the one winner, not the one hundred thousand losers

When we focus only on the winners, we’re participating in a fallacy known as “survivorship bias,” roughly akin to the phrase “the victors write the history.” We hear about Tim Ferriss and Tony Robbins and are motivated by their inspirational speaking and sales techniques, but they are at the top of a steep, difficult pyramid that may not even be open to newcomers. You probably can’t copy today what they did. We only listen to the one winner, not the one hundred thousand losers. Still, once you’ve explained all the risks, let your kids try their dumb schemes (within the bounds of law and morality) while you’re close by to guide and coach them. After all, I’m sure that Mark Zuckerberg’s parents thought “The Facebook” was a pretty dumb scheme in 2004. But they let him drop out of Harvard as a sophomore to pursue his scheme. If xkcd.com had been around at the time, they might have made him read the comic below:

What ages of kids will enjoy Make Your Kid a Money Genius?

Our DistribuFun histogram for Make Your Kid a Money Genius histogram agrees entirely with the book’s guideline of “3 years & up” because in each chapter, the author provides dedicated sections targeted to six different age groups. The advice is packed with age appropriate material for kids that are old enough to talk, all the way through your adult children who are buying their first house. Parents are the actual audience, of course, but many teenagers will be able to read the book for themselves.

Value and longevity: Is Make Your Kid a Money Genius a good buy?

At around $15, Money Genius is a decent value. The physical version is a paperback with a fancy cover, so that’s why it’s more expensive than a typical trade paperback. There are very few diagrams, charts or studies included, and no color illustrations or anything fancy. A few lonely tables and lots of bold bullet points are all you get.

The book’s content shouldn’t get stale very quickly. It’s filled with personal stories that illustrate solid principles, so this small investment should last your entire journey of child rearing. When your grandkids arrive, maybe you’ll be able to upgrade to the VR holographic edition.

Learn Richly Learning toys, educational games and STEM resources

Learn Richly Learning toys, educational games and STEM resources